Taxes

Overview

Taxes are applied to products using several different settings. These settings together let different types of products be taxed at different rates at a location.

- Tax rates are setup at the org level

- Products have a tax category assigned to them

- For every tax category that is used at a location, a tax rate should be applied

- Avanti Markets does not offer tax advice and cannot advise you on what taxes should be collected in any jurisdiction.

Generally speaking, you are going to configure your Tax Rates and Tax Categories when you first start using AMS or you enter a new jurisdiction. You are going to setup Location Tax Rates every time you open a new market location.

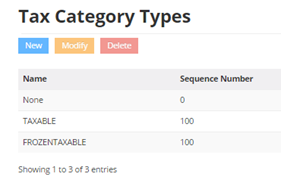

Tax Categories

If tax is going to be applied to a product a tax category must be assigned to the product.

In many jurisdictions there are things that are taxable and things that are not taxable and everything that is taxed is taxed at the same rate. If this is the case only one tax category is needed, frequently a category called TAXABLE will be created. All of the products that are not taxed may have the tax category set to none or a category called NONTAXABLE.

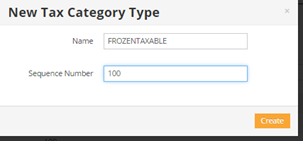

In some jurisdictions different types of products are going to be taxed at different rates. When setting up your tax categories it is best to setup a category for each type of product that is taxed differently, for example if frozen food is taxed differently than ready to eat food you would want to setup two different tax categories, maybe FROZENTAXABLE and READYTOEATTAXABLE.

Sometimes you will have one market in a jurisdiction that matches the first example and one market in a different jurisdiction that matches the second example. In this case you would want to configure your tax categories for the jurisdiction in the second example because you can always assign the same tax rate to both FROZENTAXABLE and READYTOEATTAXABLE.

Note: AMS supports assigning different tax rates to a products at the location level so in the Org level product catalogue every product could have the categories TAXABLE and NONTAXABLE even if you needed to assign some of them to a different category at the location level. It is recommended to set the tax categories at the org level whenever possible.

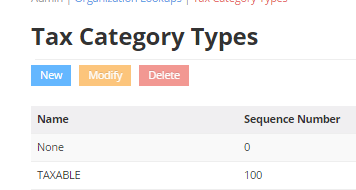

Creating a Tax Category

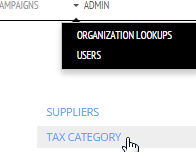

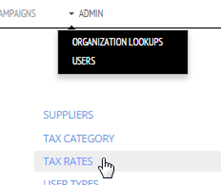

To create a new Tax Category go to Admin > Organization Lookups and click Tax Category

Click New

Choose a name and a Sequence number (just use 100 if you are unsure) and click create

Now the new category is created

Tax Rates

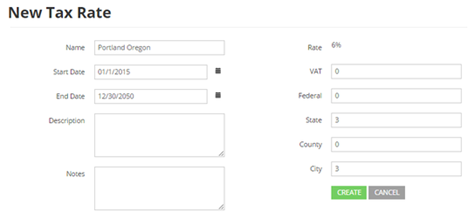

Tax Rates in AMS are the combined tax rate (federal, state and local) that should be applied to a particular Tax Category. So if there is a 3% state sales tax on everything and a an additional 3% city sales tax on everything then a tax rate of 6% would need to be setup.

Creating a Tax Rate

To setup a tax rate go to Admin > Organization Lookups > Tax Rates

Click New Tax Rate

For the above example we would setup of the above example

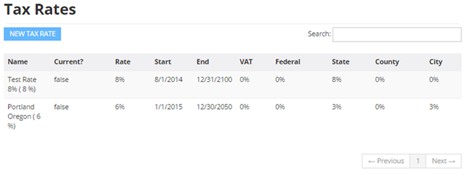

It would now be listed, to edit or delete a rate just click on it.

In some jurisdictions there will be several different tax rates for items that are taxable, for example if ready to eat food is taxed at 5% but frozen food is only taxed at 3% and shelf stable snacks are not taxed at all.

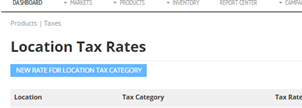

Location Tax Rates

Each location can have many different products which may have several different tax categories. It is important to apply a tax rate for each tax category that is being used at the location.

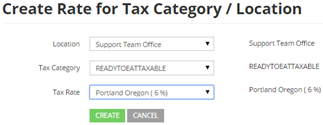

Creating a Location Tax Rate

Go to Products > Taxes

Click New Rate For Location Tax Category

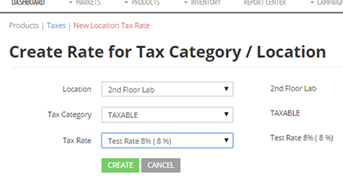

Choose the Location, Tax Category and Tax Rate and click create

When we go back to the location tax rates page we can see that the tax rate called Test Rate is going to be applied to everything with the tax category called TAXABLE. If there are products extended to the location with a different tax category a tax rate needs to be applied to those as well.

Example

Once your tax rates and tax rates are configured it is straight forward to set up the taxes on a new location. The below example will illustrate what must be done.

We have just opened a market that is used by our support team called Support Team Office. There are products that are assigned the following tax categories extended to the location.

- TAXABLEFROZEN

- TAXABLEREADYTOEAT

- TAXABLE

The jurisdiction that the market is located in just used one tax rate for all of the items which are taxable it is called Portland Oregon (6%). We would just need to set up a rate for each of the categories.